When I started Forex trading, using moving averages is one of the simplest yet effective strategies to trade. Moving averages are very popular trend-following tools. There are 2 types of moving averages that I have tried – Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). Neither one is better than the other but we need to know the difference before we can make money with moving averages. Below is an explanation of the 2 types of moving averages.

When I started Forex trading, using moving averages is one of the simplest yet effective strategies to trade. Moving averages are very popular trend-following tools. There are 2 types of moving averages that I have tried – Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). Neither one is better than the other but we need to know the difference before we can make money with moving averages. Below is an explanation of the 2 types of moving averages.

Simple Moving Averages (SMA)

Simple Moving Average (SMA) helps smooth the price action to help define the trend and is a lagging indicator built on past data. The SMA helps filter out noise of the daily volatility of the price action. This is one of the best qualities of moving averages. It is simply the average of the closing price over the past defined period. Based on the period, the SMA will drop off the old data and add the new day. This is why they call it a “moving average”.

SMA represent a true average of prices for the entire time period. As such, SMA may be better suited to identify support or resistance levels.

Exponential Moving Averages (EMA)

Exponential Moving Average (EMA) also smooth the price to help define the trend, but it reduces the lag by applying more weight to the recent prices. So, EMA will turn before SMA base on recent price changes. This is the main difference between the two different moving averages.

Now that we understand the two different types of moving averages, it still have to depend on objectives, analytical style and time frame. Traders who use charting techniques, should experiment with both types of moving averages as well as different timeframes to find the best fit. Let’s take a look at the different types of strategies that would work when trading with moving averages.

Price Crossover Strategy

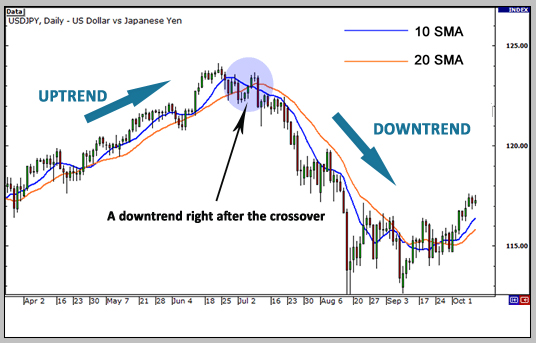

A crossover is the most basic type of signal and is much popular among many traders because it removes the emotional factor from trading. The most basic type of crossover occurs when the price moves from one side of a moving average and closes on the other side. As we’ve discussed, price crossovers are used by traders to identify shifts in momentum and can be used as a basic entry or exit strategy. As you can see in the below chart, a cross above a moving average can signal the beginning of a uptrend and would likely be used by traders as a signal to close out any existing short positions. Conversely, a close below a moving average from above may suggest the beginning of a new downtrend.

Two Moving Average Crossovers Strategy

There are several ways to make money trading with moving averages beside the above price crossover strategy. Two moving averages is the second type of crossover that can be used to generate entry or exit signals. This signal is used by traders to spot when momentum is shifting in one direction and that a strong move is likely approaching.

A buy signal is generated when a short-term moving average crosses above a long-term moving average, while a sell signal is triggered by a short-term moving average crossing below a long-term moving average. As you can see from the chart below, this signal is very objective, which is why it’s so popular.

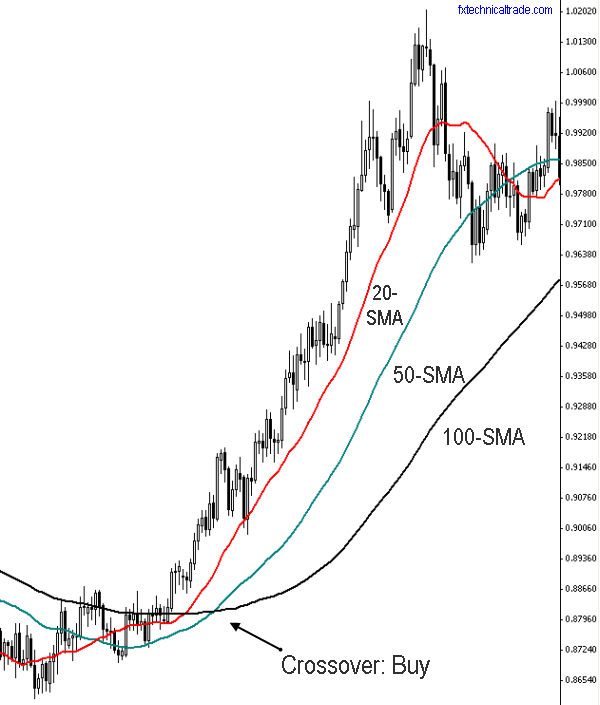

Three Moving Average Crossovers Strategy

To get a better confirmation on the trend, some traders would use the 3 moving average crossovers strategy. Supplementary moving averages may be added to the chart to increase the strength of a signal. Many traders will place the 20-, 50-, and 100-day moving averages onto a chart and wait until the 20-day MA crosses up through the others – this is generally the primary buy sign. Waiting for the 50-day MA to cross above the 100-day MA is often used as confirmation, an approach that can reduce the number of false signals. Increasing the number of moving averages, as seen in the triple crossover method, is one of the best ways to gauge the strength of a trend and the likelihood that the trend will continue.

EMA & SMA Crossover Strategy

This is a very interesting strategy that I have learned. It uses the strengths and weaknesses of each of the different types of moving averages. As the EMA has more weights on the most recent price than the rest of the prices, so it tends to move faster than the SMA. So with that in mind, we can pair these two different types of moving averages with the EMA being your crossover line and the SMA being our signal line. For example, when the 10-day EMA crosses the 200-day SMA, it generates a buy signal as shown below.

It is very important that you understand, trading with moving averages is a trend following strategy. They will not work in sideway and choppy markets. In order for this type of strategy to work, you would need to catch a trend. That is why it is called a trend trading strategy. The biggest concern when trading with moving averages is the problem of getting whipsawed. Whipsawed is when your signals continually get you in and out of a position over a short time frame without making money. Trend strategies can have problems in this area and you have to be mentally prepared to handle this type of risk.

To increase our confidence in trading, it is recommended that we wait for a pair to cross above a moving average and is at least 10% above the moving average before placing an order. This is an attempt to make sure the crossover is valid and to reduce the number of false signals. The downside is that some of the gain is given up and could lead us “missing the boat”. There are no set rules or things to look out for, it’s simply an additional tool that will allow us to invest with confidence.

I will not guarantee that trading with moving averages will work for you. It takes time and discipline to master it. Anyway, our ultimate goal is to make money. I hope this information helps you on your journey to become a better trader and make more money!!!